Certification audits play a pivotal role in ensuring that organizations comply with established quality management standards and regulations. These audits, conducted by accredited certification bodies, validate the effectiveness of an organization's quality management system (QMS) and its adherence to specified standards such as ISO 13485, ISO 9001, ISO 14001, ISO 45001, or industry-specific regulations.

Certification audits are assessments conducted to determine whether an organization's QMS meets the requirements outlined in the chosen standard or regulation. These audits are typically conducted in multiple stages and involve thorough examination of documentation, processes, and practices within the organization.

Key Steps in the Certification Audit Process:

Preparation- Document Review: Auditors review relevant documentation, including quality manuals, procedures, and records, to assess compliance.

- Team Selection (Audit Team Nomination): A team of auditors with expertise in the chosen standard and the organization's industry is selected.

- Agreement Sign: Confidentiality and other neccessary agreeemnst signed by Auditors

- Audit Plan: An audit plan outlining the scope, objectives, and schedule of the audit is developed.

- Document Review: Auditors verify the implementation and effectiveness of documented procedures and processes.

- Interviews: Personnel at all levels are interviewed to assess their understanding of quality management principles and their roles in the QMS.

- Observations: Auditors observe processes and activities in action to identify any deviations from the standard requirements.

- Non-conformities: Any non-conformities or areas of non-compliance with the certification standard are identified and documented.

- Observations: Opportunities for improvement are recorded along with any observations made during the audit process.

- Presentation of Findings: Audit findings, including non-conformities and observations, are presented to key personnel.

- Discussion: A discussion takes place to clarify findings and address any questions or concerns.

- Next Steps: The next steps in the certification process, including corrective actions, are outlined.

- Audit Report: A comprehensive audit report detailing findings, non-conformities, observations, and recommendations is prepared.

- Distribution: The audit report is distributed to key stakeholders, including top management and the certification body.

- Corrective Actions: The implementation of corrective actions to address non-conformities is monitored.

- Closure: Non-conformities are closed out once corrective actions have been successfully implemented and verified.

- Review: The certification body reviews the audit report and makes a decision regarding certification.

- Certification: If the organization meets the requirements of the standard, certification is granted.

- Ongoing Compliance: Regular surveillance audits are conducted to ensure ongoing compliance with the certification standard.

- Feedback: Feedback from the certification audit process is used to drive continuous improvement in the organization's QMS.

Certification audits are critical for organizations seeking to demonstrate their commitment to quality and compliance with established standards. By following a structured audit process and addressing any identified non-conformities, organizations can achieve and maintain certification, while also driving continuous improvement in their quality management systems.

Roles & Responsibilities of Auditors

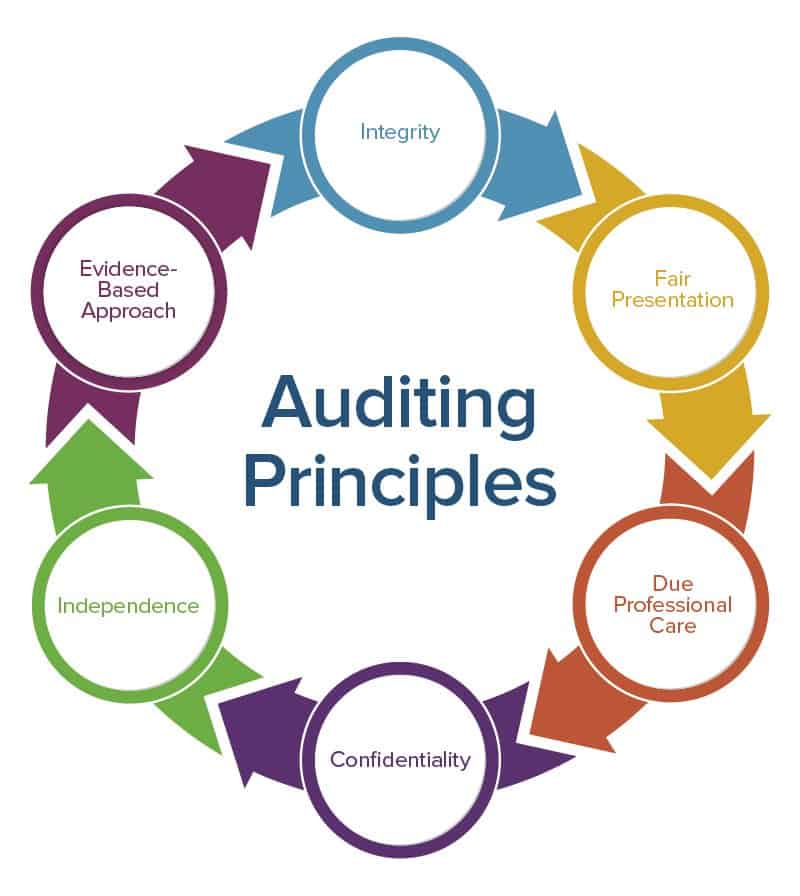

Auditors play a crucial role in ensuring the effectiveness and compliance of organizational processes through audits. To uphold the integrity and impartiality of the auditing process, auditors should adhere to certain guidelines (ISO 19011) and standards while exercising their rights:

- Impartiality: Auditors must maintain impartiality and independence throughout the auditing process, avoiding conflicts of interest or bias.

- Professionalism: Auditors should conduct themselves in a professional manner, upholding ethical standards and respecting confidentiality requirements.

- Competence: Auditors must possess the necessary skills, knowledge, and experience to effectively assess the organization's processes and compliance with standards.

- Preparation: Prior to conducting audits, auditors should thoroughly review relevant documentation, standards, and procedures to ensure a comprehensive understanding of the audit scope.

- Communication: Auditors should communicate clearly and effectively with auditees, explaining the purpose and objectives of the audit and providing guidance on audit processes and requirements.

- Documentation: Accurate and detailed documentation of audit findings, observations, and non-conformities is essential to provide an objective assessment of the organization's compliance.

- Objectivity: Auditors must approach audits with objectivity and open-mindedness, basing their assessments solely on evidence and factual observations rather than personal opinions or biases.

- Timeliness: Auditors should adhere to established audit schedules and timelines, ensuring audits are conducted promptly and efficiently to minimize disruptions to organizational activities.

Rights of Auditors:

- Access to Information: Auditors have the right to access relevant documentation, records, and personnel necessary to conduct audits effectively.

- Independence: Auditors should have the autonomy to conduct audits without undue influence or interference from organizational stakeholders, ensuring the integrity of audit processes.

- Confidentiality: Auditors have the right to maintain the confidentiality of audit-related information and findings, disclosing information only to authorized individuals or parties as required by audit protocols.

- Report Issuance: Auditors are entitled to prepare and issue audit reports documenting their findings, observations, and recommendations based on their assessments.

- Feedback: Auditors should have the opportunity to provide feedback on the audit process, including recommendations for improvement and areas for further attention.

- Training and Development: Auditors have the right to receive ongoing training and professional development opportunities to enhance their auditing skills and knowledge.\

- Refuge to Audit or Abandon the Audit: The Auditor may abandon the audit in mid or refuge to conduct audit upon valid reason, in any case decision of Certification/Notified body deemed final.

As an auditor, it's important to adhere to certain principles and guidelines to ensure professionalism, integrity, and effectiveness in conducting audits.

Auditor Should Not;

- Jump to conclusions: Avoid making assumptions or premature judgments based on limited information or personal biases.

- Overlook risks: Identify and assess potential risks and vulnerabilities in the audit process, taking proactive measures to mitigate them.

- Be confrontational: Maintain a professional and respectful demeanor during interactions with auditees, avoiding confrontational or adversarial behavior.

- Ignore feedback: Welcome feedback and input from auditees, stakeholders, and other relevant parties, considering their perspectives and insights.

- Miss deadlines: Adhere to established timelines and deadlines for audit activities, ensuring timely completion and reporting of audit findings.

- Overstep authority: Respect boundaries and limitations of your role as an auditor, avoiding interference in operational or managerial decisions.

- Rely solely on documentation: Supplement documentary evidence with firsthand observations, interviews, and other sources of information to gain a holistic understanding of the audit subject.

- Disregard continuous improvement: Seek opportunities for learning, growth, and improvement in audit practices, processes, and outcomes, fostering a culture of continuous improvement.

Roles & Responsibilities of Auditee

The auditee, or the entity being audited, has certain rights during the audit process to ensure fairness, transparency, and respect for their interests. Here are some of the key rights of the auditee:

- Notification: The auditee has the right to be informed in advance about the audit, including the purpose, scope, and objectives of the audit, as well as the scheduled date and duration of the audit activities.

- Access to Information: The auditee has the right to access relevant documents, records, and information needed for the audit process. This includes providing the auditor with access to facilities, personnel, and other resources necessary to conduct the audit effectively.

- Representation: The auditee has the right to designate representatives to participate in audit activities on their behalf. These representatives may include subject matter experts, key personnel, or legal advisors who can provide insights and assistance during the audit process.

- Confidentiality: The auditee has the right to expect confidentiality and privacy during the audit process. Auditors should handle sensitive information with discretion and respect the confidentiality of proprietary or confidential data shared by the auditee.

- Fair Treatment: The auditee has the right to be treated fairly, impartially, and respectfully by the auditor. Auditors should conduct themselves professionally, avoid bias or prejudice, and refrain from making unfounded assumptions or accusations during the audit process.

- Opportunity to Respond: The auditee has the right to respond to audit findings, observations, and recommendations provided by the auditor. This includes the opportunity to clarify any misunderstandings, provide additional information or evidence, and address any discrepancies or concerns identified during the audit.

- Appeal Process: If the auditee disagrees with the audit findings or believes that they have been treated unfairly, they have the right to seek recourse through an appeal process. This may involve escalating concerns to higher levels of management, requesting a review of the audit findings, or filing a formal complaint through established channels.

- Feedback: The auditee has the right to provide feedback on the audit process, including their experience, concerns, and suggestions for improvement. This feedback can help to enhance the effectiveness and efficiency of future audit activities and promote continuous improvement within the organization.

- Refuge to accept the NC or Findings: The auditee may refuge to accept the finding or NCs upon giving valid justifications. i.e For Multiple NCs addressing single requirement, NCs which are not descriptive in nature or thier indent/purpose is not clear, NCs which are not mentioning what is required against the clause/standard.

Non-Conformities in Audits: Understanding Common Findings and Auditor Feedback

During audits, auditors often identify non-conformities (NCs) that may seem unclear or difficult to decipher for organizations. These NCs can leave auditees puzzled about the underlying issues and corrective actions needed. This section aims to demystify common audit non-conformities, shedding light on what auditors intend to convey with their feedback.

Interpreting Common Audit Non-Conformities:- Ambiguous Standard Requirements: Auditors may flag instances where documented procedures or processes appear to deviate from standard requirements. While the NC might seem vague initially, it underscores the importance of aligning organizational practices with established standards and guidelines. However it is recomended that auditor should clearly demonstrate what is missing which shall be included as per standard requirements.

- Lack of Clarity in Adherence to Standards: When auditors highlight non-compliance with recognized standards or industry best practices, it's essential to seek clarification on specific areas of concern. This NC indicates the need for a deeper understanding of regulatory requirements and their implications for organizational processes.

- Documentation Gaps and Inconsistencies: Instances of inadequate documentation can be challenging to interpret without context. Auditors may identify missing or outdated records, signaling the need for improved documentation practices and better record-keeping procedures.

- Deviations from Established Procedures: When auditors point out deviations from approved procedures or protocols, it's crucial to investigate the root causes behind these discrepancies. This NC highlights potential gaps in process adherence and the importance of following established workflows.

- Training and Competency Deficiencies: NCs related to employee training and competence may indicate gaps in skills or knowledge within the organization. Understanding the specific areas where personnel lack proficiency can help tailor training programs to address these shortcomings effectively.

To better understand and address audit non-conformities, organizations should engage in open dialogue with auditors to gain clarity on the identified issues. Asking questions, seeking examples, and requesting additional context can help unravel the meaning behind audit feedback. By collaborating with auditors and fostering a culture of continuous improvement, organizations can effectively address NCs and enhance their overall compliance and performance.